Is it true that if you eat cheese before bed you have nightmares? Coz Freddy Kruger here I come! : r/grilledcheese

Is it true that if you eat cheese before bed you have nightmares? Coz Freddy Kruger here I come! : r/grilledcheese

A peanut butter and cheese sandwich, eaten on my bed at 3am christmas morning because I can't sleep : r/shittyfoodporn

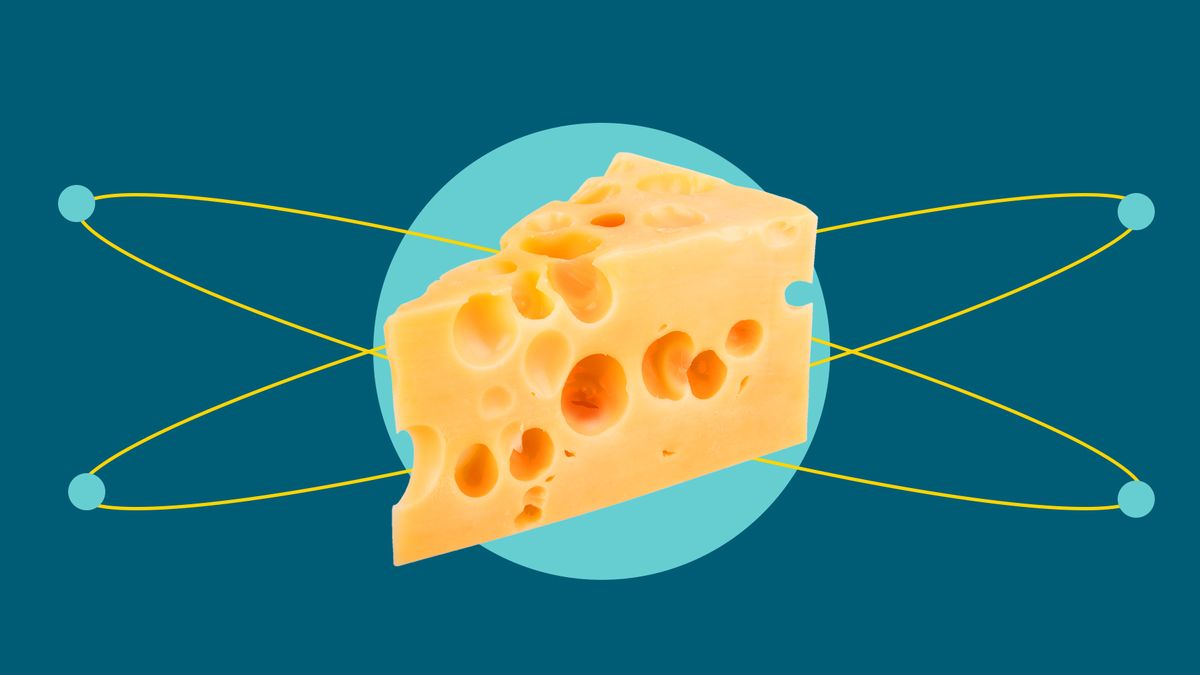

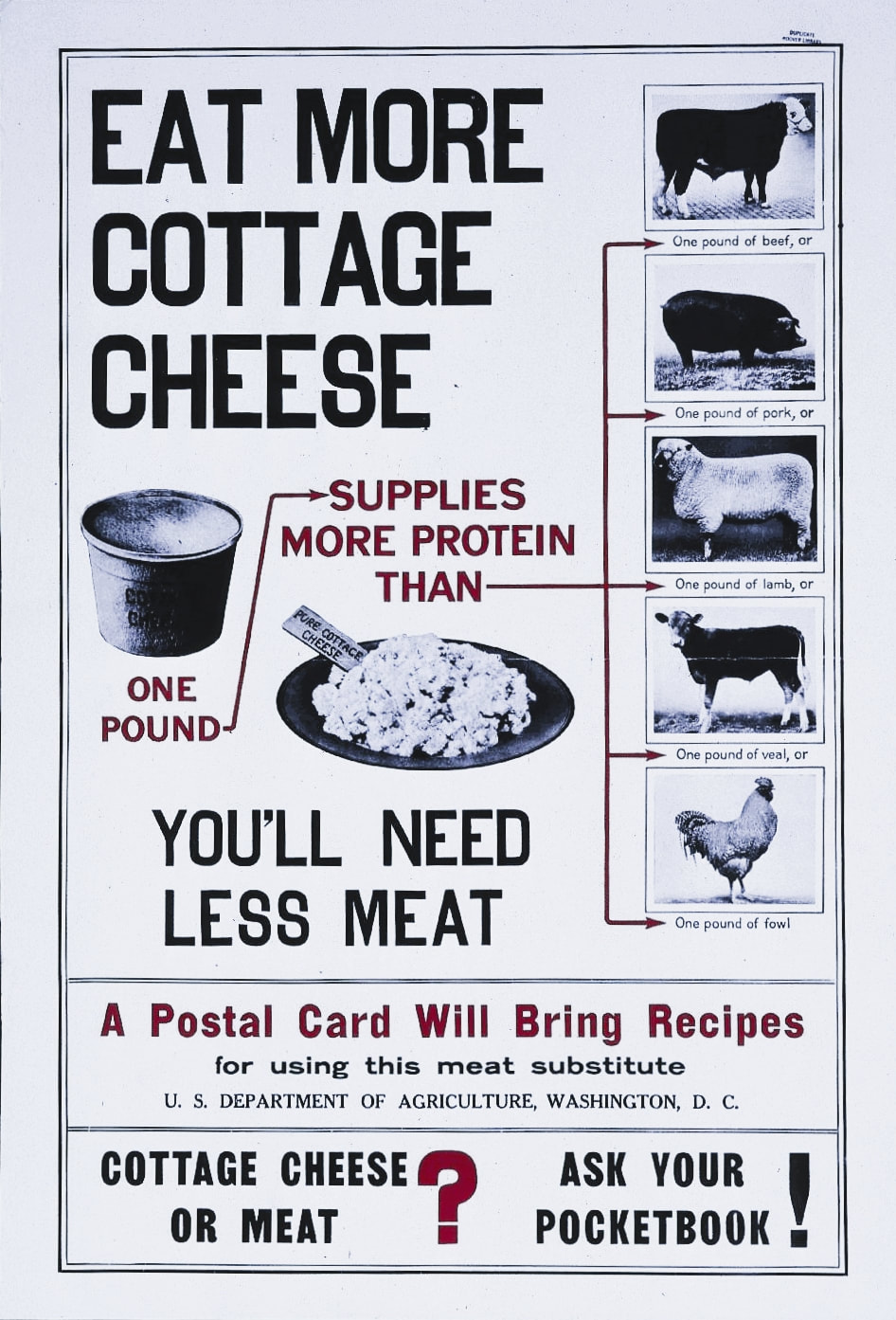

TIL: Eating cheese before bed probably doesn't cause nightmares and eating small amounts of it may even improve sleep quality. : r/todayilearned

My dinner: 300kcal salad including tuna, avocado and cottage cheese on a bed of aragula : r/1200isplenty

![Broccoli mac n cheese before bed [290 calories] : r/1200isplenty Broccoli mac n cheese before bed [290 calories] : r/1200isplenty](https://i.redd.it/x7hlqmxkk2411.jpg)

![Homemade] Egg and cheese bagles with grape jelly and cream cheese : r/food Homemade] Egg and cheese bagles with grape jelly and cream cheese : r/food](https://preview.redd.it/hgbj6rkrve871.jpg?width=640&crop=smart&auto=webp&s=6af3198added0b38f116c6b4517dd9ead8f90408)